This episode kicks off the Model Citizens miniseries and examines what happens when the CFPB’s power recedes—creating a patchwork of 50-state oversight, shifting rules, and new legal risks for banks and fintechs.

- Alex Johnson — Host, Fintech Takes.

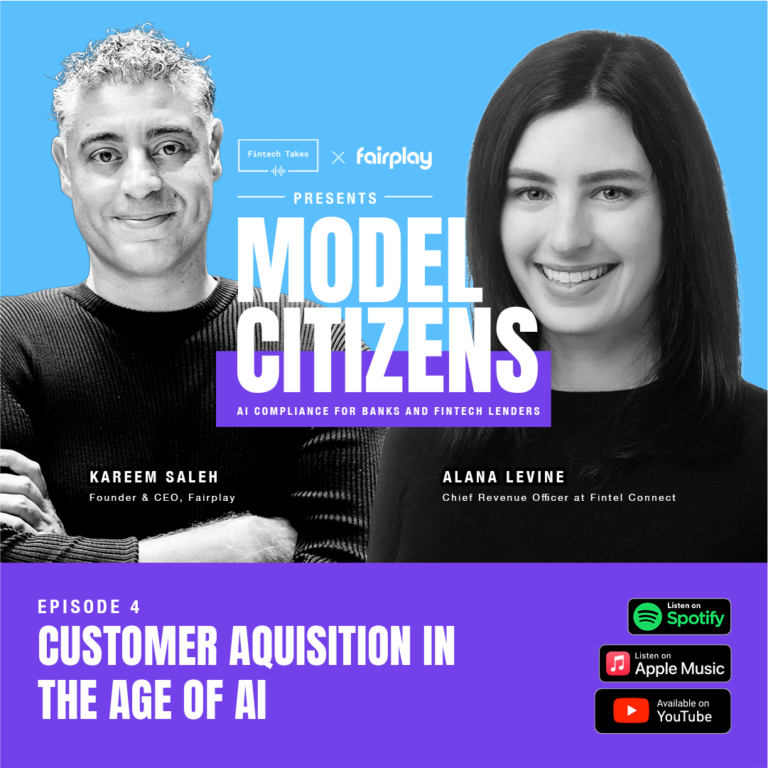

- Kareem Saleh — CEO, FairPlay.

- Abby Hogan — SVP, Legal & Regulatory Affairs, FairPlay; former CFPB.

- David Silberman — Former Associate Director (Research, Markets, Regulation) at CFPB; now policy expert.

The CFPB’s weakening and the rise of state-level enforcement, five-year lookbacks, why “50‑state compliance” is the most expensive form of deregulation, and how pragmatic state regulators are becoming an R&D lab as fintech innovation outpaces rulemaking. They also consider whether and how the CFPB could be rebuilt.

Why it matters: Without a singular federal “cop on the beat,” lenders face more fragmented, faster‑changing obligations. Navigating AI‑driven lending under disparate state regimes demands stronger governance, documentation, and consumer fairness practices—or risk penalties, litigation, and stalled product velocity.