Data

Models

Agents

Tested

Optimized

Validated

Trusted

The all-in-one platform for AI and agentic testing, optimization and validation.

Test, tune, and validate the intelligence driving your business.

Designed for banks, fintechs, and insurance carriers that need precision, speed, and proof.

Accelerate risk reviews. Cut onboarding by weeks. Stay exam-ready.

Data

Models

Agents

Tested

Optimized

Validated

Trusted

The all-in-one platform For AI and agentic testing, optimization and validation.

Test, tune, and validate the intelligence driving your business.

Designed for banks, fintechs, and insurance carriers that need precision, speed, and proof.

Accelerate risk reviews. Cut onboarding by weeks. Stay exam-ready.

Test high-risk AI models and agents

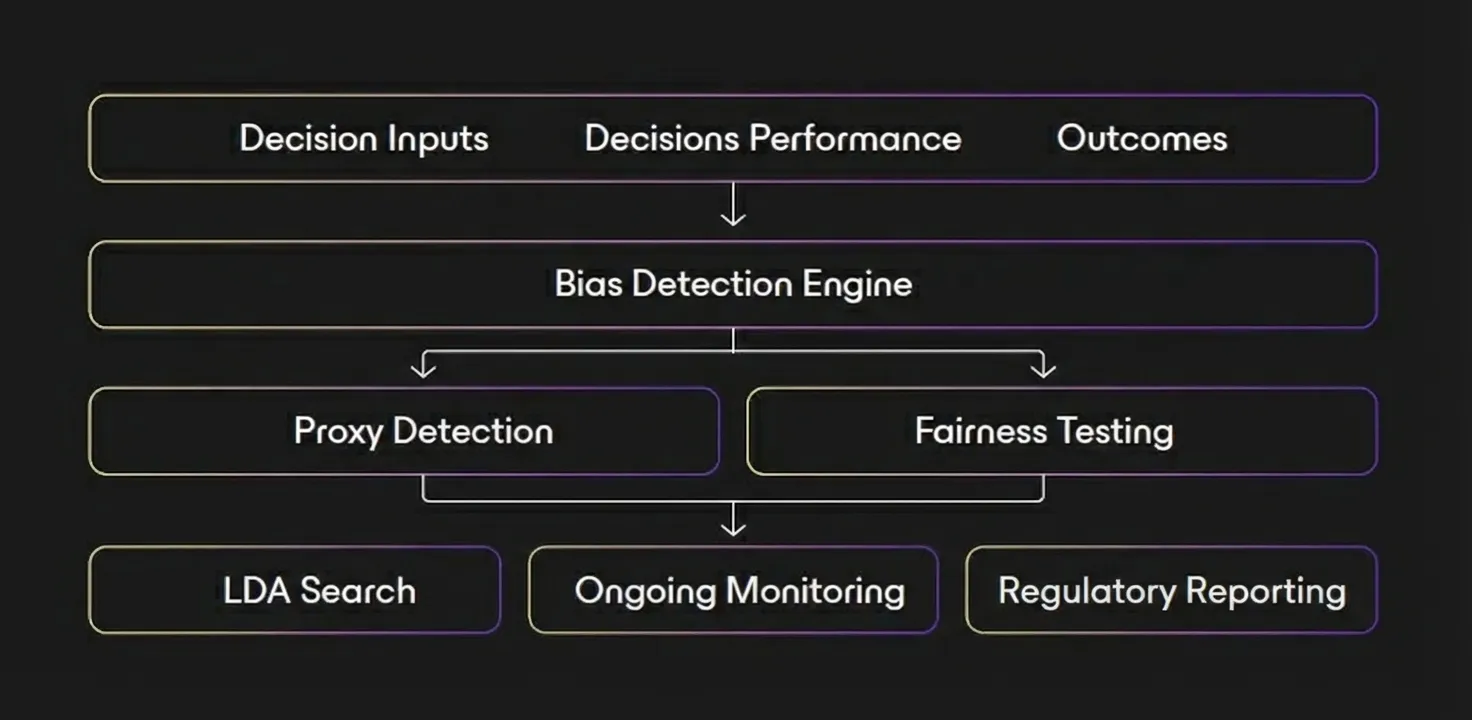

Comprehensive testing for bias and fairness.

Optimize model and agentic performance

Maximize accuracy while ensuring compliance.

Govern traditional, ML, and agentic systems

Independent validation and red-teaming aligned with SR 11-7

Test, Validate and Optimize

ML Models

Increase accuracy. Expand access. Satisfy regulators. Test and optimize model and agentic performance to identify and correct bias, improve risk ranking, and generate regulatory-ready documentation in record time

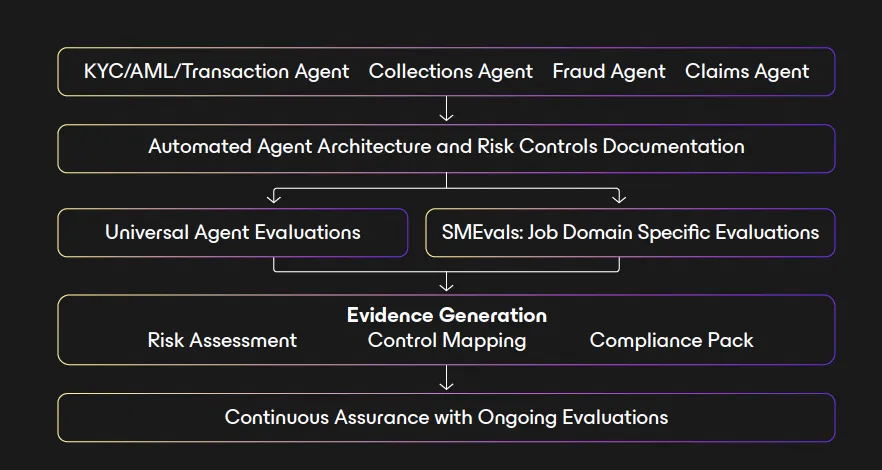

AI Agents

Autonomy without anarchy. Validate agent behavior, guardrails, and governance before go-live. Detect rogue actions, prove safe deployment, and get go/no-go clarity—fast.

Safe AI Sourcing

Smarter, safer, faster AI procurement. Evaluate third-party AI vendors before you buy. Run fast, independent assessments of third-party data, models, and agents. Get clear go/no-go logic, remediation steps, and compliance-aligned documentation.

The Challenge

Financial institutions need to deploy AI faster than they can validate it.

Traditional approaches can’t keep pace.

61%

High-Risk Models Lack Regular Validation

The OCC reports that most high-risk models go without routine validation. Teams are prioritizing what they can manage, but current tools simply can’t deliver the coverage and rigor regulators expect.

$500K+

Annual Cost of Validation & Exam Prep

3-9 Months

to validate a single high-risk model

That's how long it can take using traditional approaches — consultants, manual testing, back-and-forth documentation cycles. In the time it takes to validate one model, your AI team has built the next three.

The FairPlay Advantage

Real outcomes from enterprise deployments at banks and fintechs

5x

Faster to Production

Validation cycles cut by 70-80%, moving from months-long timelines to days.

50%

Reduction in External Costs

Replace expensive consultants and manual testing with scalable, automated workflows

3x Capacity +

Exam-Ready Documentation

Do more with your existing team. Auto-generated, SR 11-7 compliant documentation from day one

10–20%

Higher approval rates

Optimize model performance and financial inclusion without increasing risk. Unlock the revenue your current models leave on the table

The Challenge

Financial institutions need to deploy AI faster than they can validate it.

Traditional approaches can’t keep pace.

Proven Impact

Real results from enterprise deployments.

61%

High-Risk Models Lack Regular Validation

The OCC reports that most high-risk models go without routine validation. Teams are prioritizing what they can manage, but current tools simply can’t deliver the coverage and rigor regulators expect.

$500K+

Annual Cost of Validation & Exam Prep

3-9 Months

to validate a single high-risk model

That's how long it can take using traditional approaches — consultants, manual testing, back-and-forth documentation cycles. In the time it takes to validate one model, your AI team has built the next three.

The FairPlay Advantage

Real outcomes from enterprise deployments at banks and fintechs

5x

Faster to Production

Validation cycles cut by 70-80%, moving from months-long timelines to days.

50%

Reduction in External Costs

Replace expensive consultants and manual testing with scalable, automated workflows

3x Capacity +

Exam-Ready Documentation

Do more with your existing team. Auto-generated, SR 11-7 compliant documentation from day one

10–20%

Higher approval rates

Optimize model performance and financial inclusion without increasing risk. Unlock the revenue your current models leave on the table

Trusted by Leading Financial Institutions

Solutions That Accelerate AI Adoption

One platform. Built for performance, speed, and safety. Govern all your intelligent systems—from scorecards to agents—with confidence and clarity.

Build

Test

Optimize

Validate

Govern

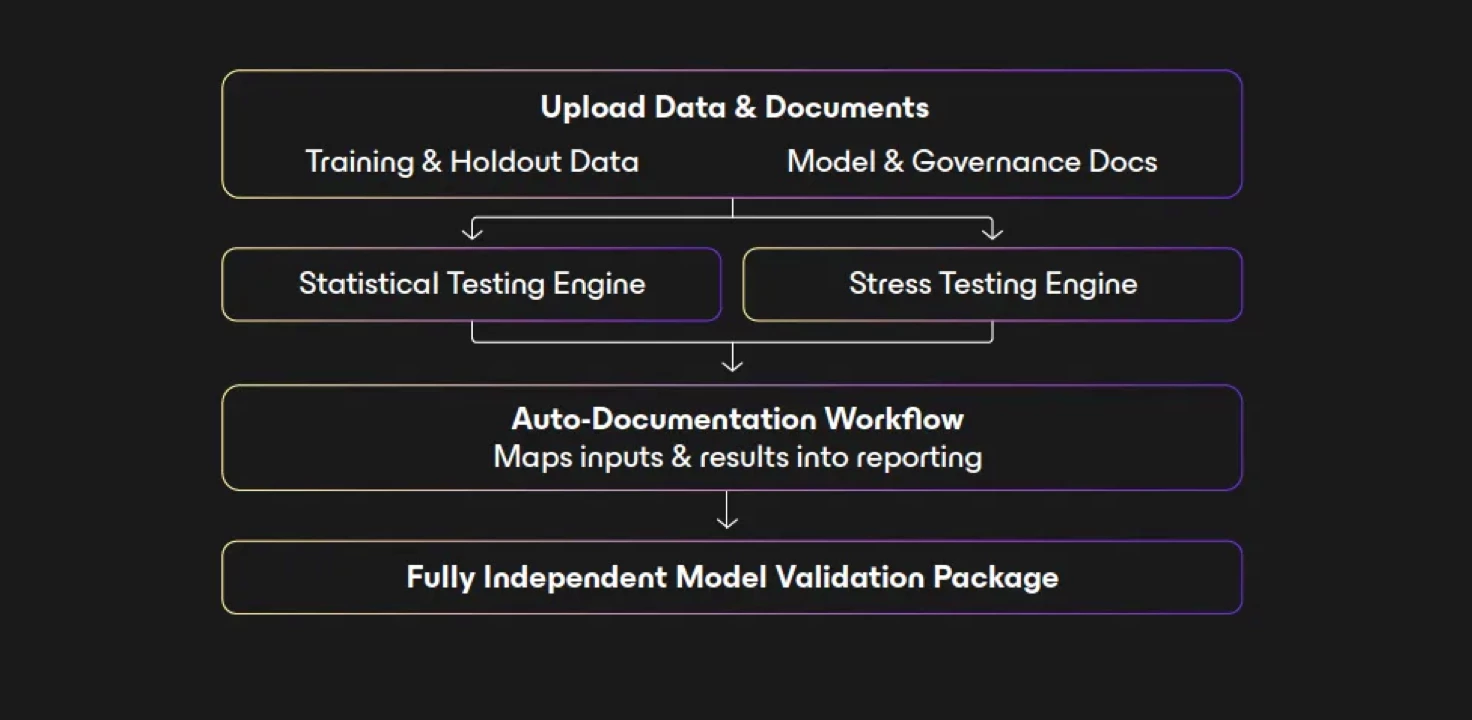

Model Validation

Automated SR 11-7 compliant validation with exam-ready documentation.

SR 11-7 Aligned

Automated Bias Testing

Test before production, monitor after deployment, surface less discriminatory alternatives, and automate fair lending reporting.

Fair Lending

Agentic Evaluations

Domain-specific evaluations for AI agents in financial services. Test how well agents actually do their jobs.

NIST AI RMF

Model Optimization

Improve approval rates and financial inclusion without increasing risk. Unlock revenue your current models leave behind.

Revenue Impact

Tools that increase performance, shorten risk reviews, lower consulting spend, and keep you exam-ready.

Platform Overview

See exactly how we transform your AI governance from months to days.

Model Citizens

Featured Podcast

AI Compliance for Banks and Fintech Leaders

Download Resources

Join leading financial institutions in building trusted AI systems.

Solutions that Accelerate AI Adoption

One platform. Built for performance, compliance, and safety.