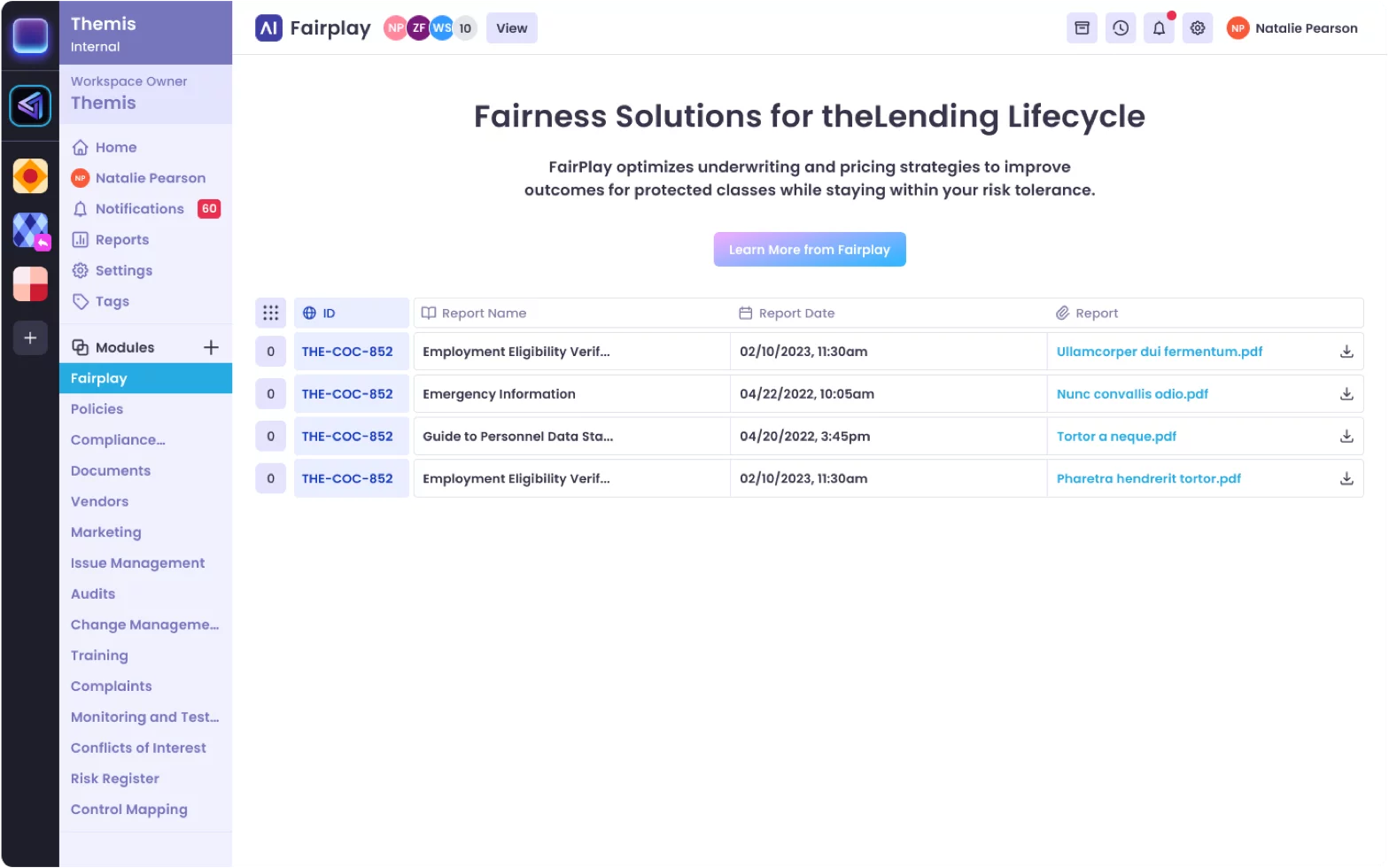

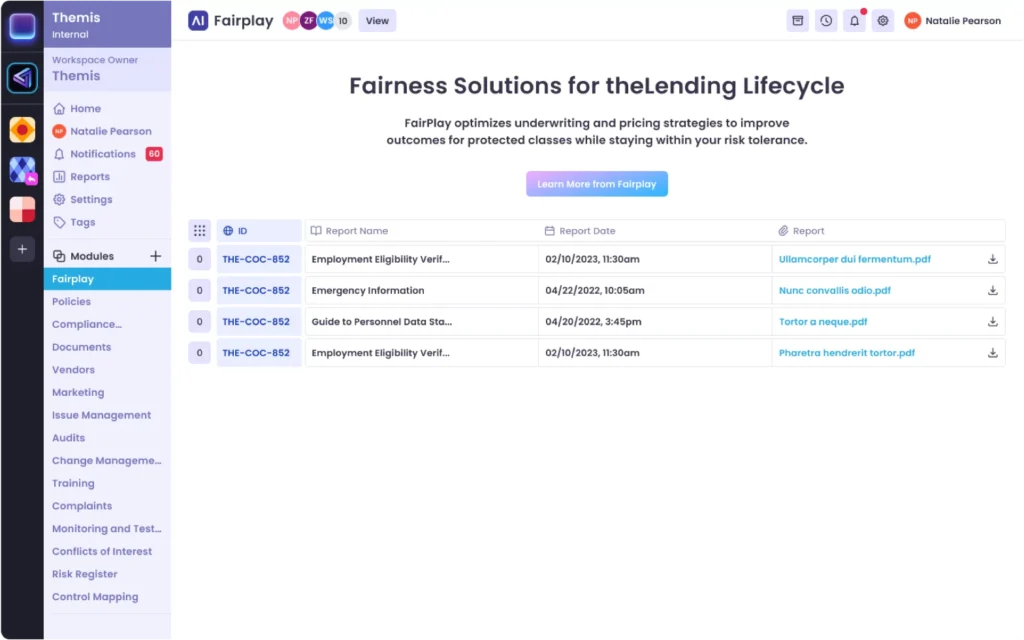

FairPlay and Themis partner to accelerate compliance collaboration

Fair Lending compliance built for sponsor banks and fintech partners.

Leading fintechs rely on FairPlay™️ for fast, accurate, fair lending results.

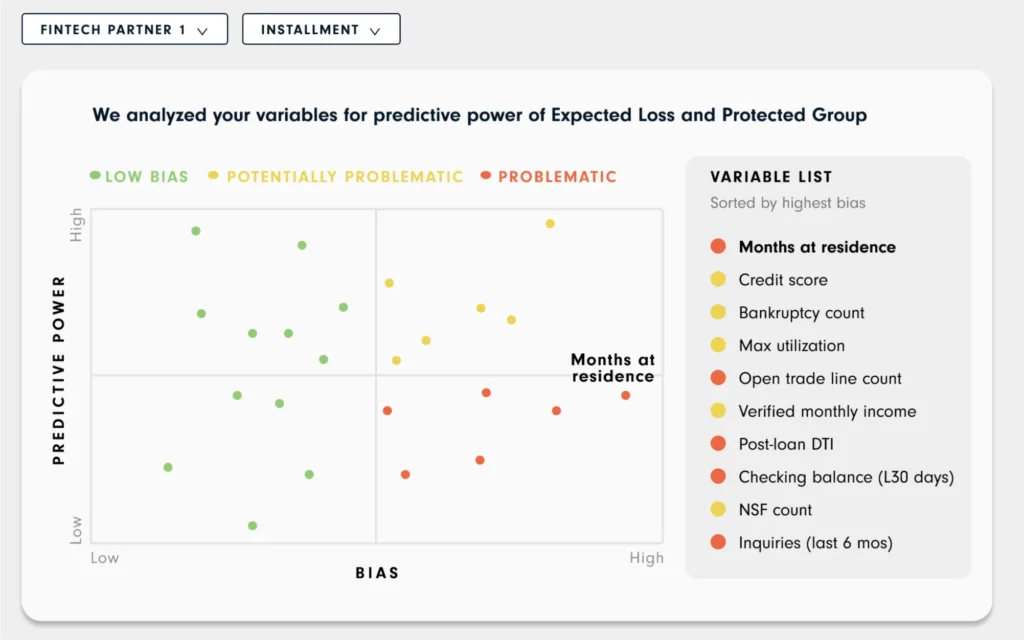

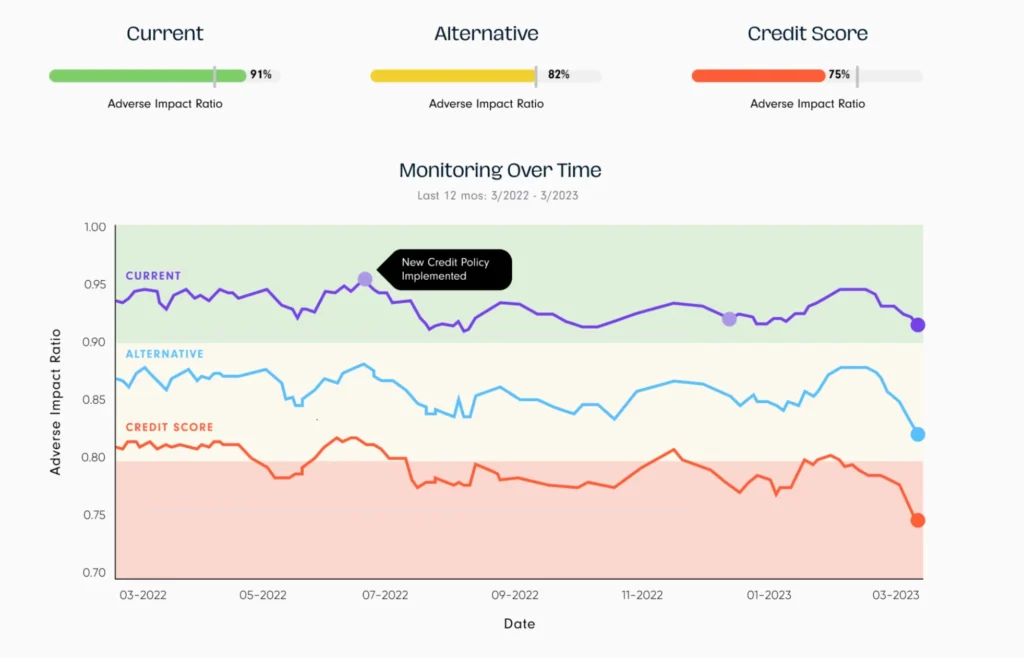

Model Change Management

Instantly assess fair lending risks arising from credit strategy changes

Partners submit new or changing credit policies for review and approval

Upload model inputs, outputs, and outcomes. Generate a Fair Lending report in minutes.

Forecast the fairness outcomes of credit policy changes and updates

Evaluate and respond to credit strategy changes proposed by your partners in minutes

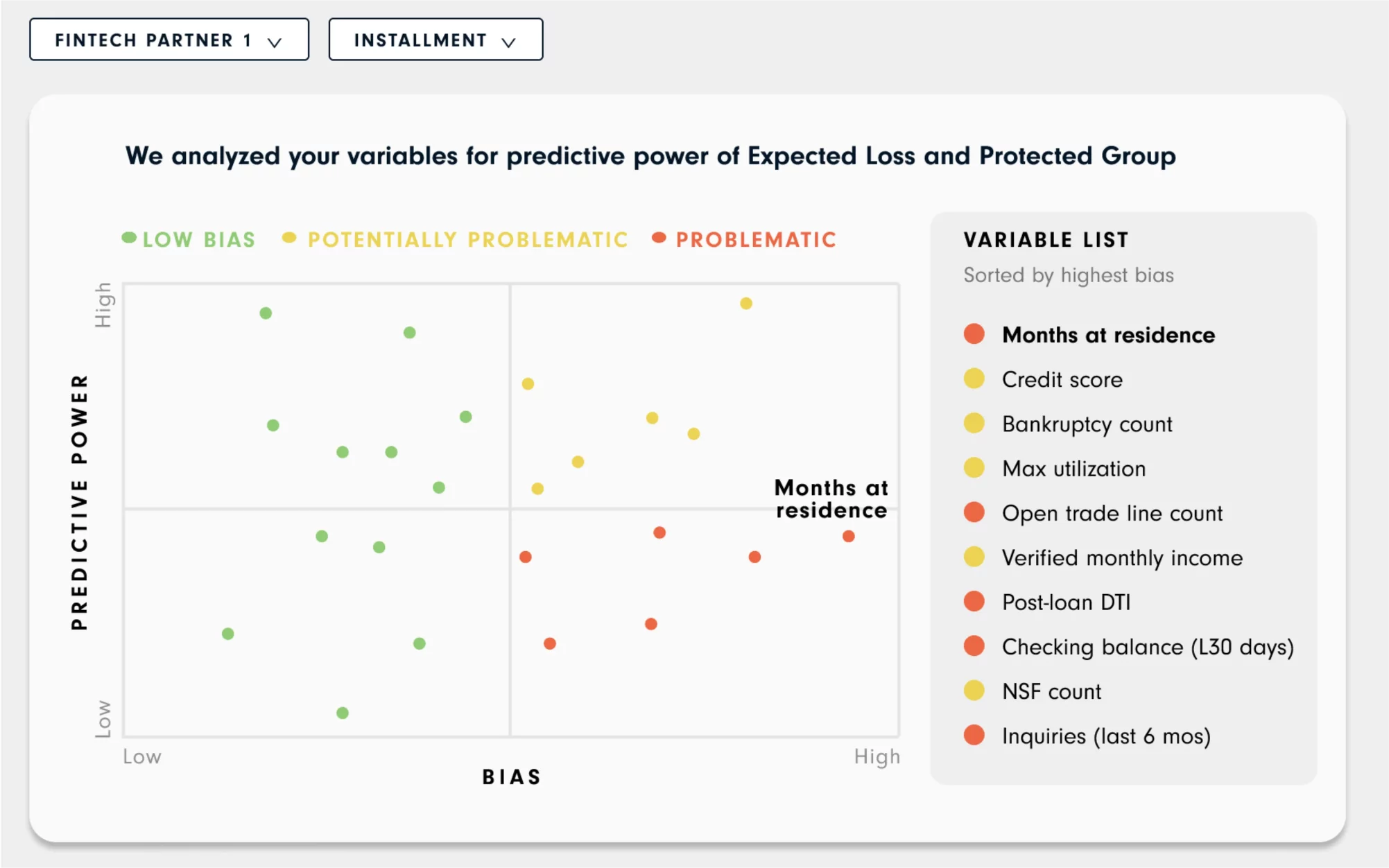

Identify areas for improvement with less discriminatory alternatives

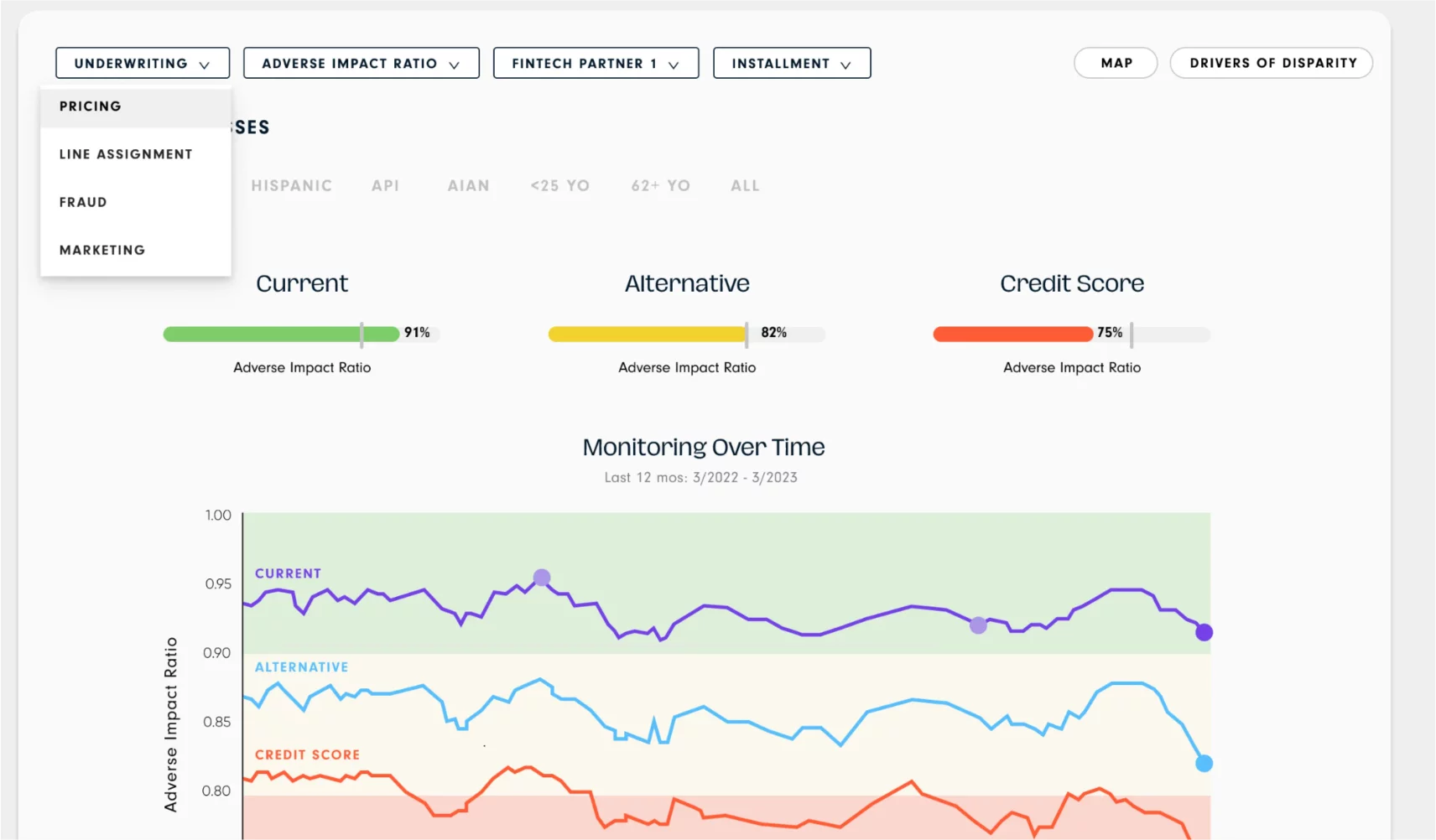

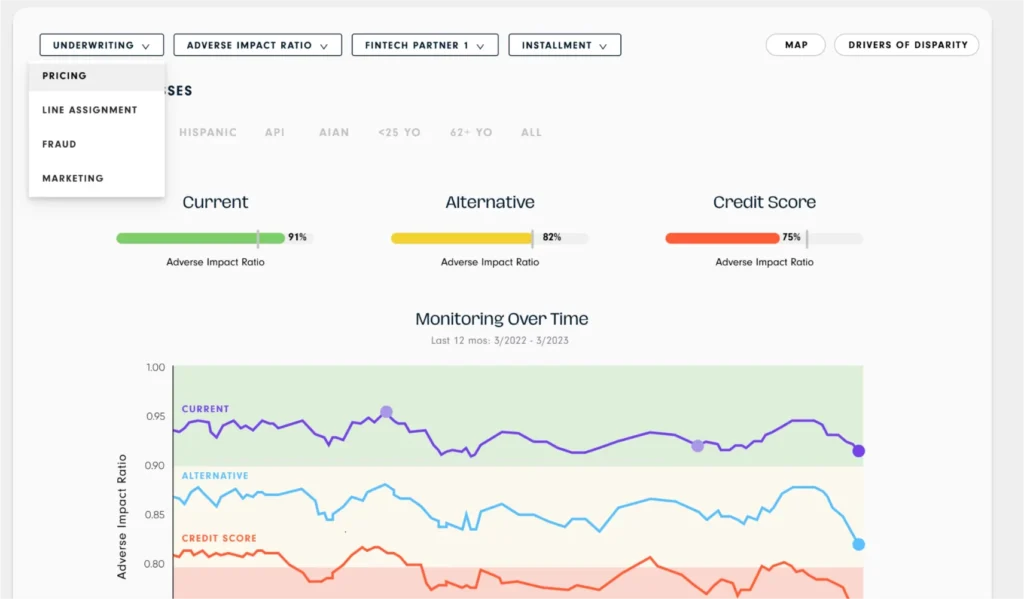

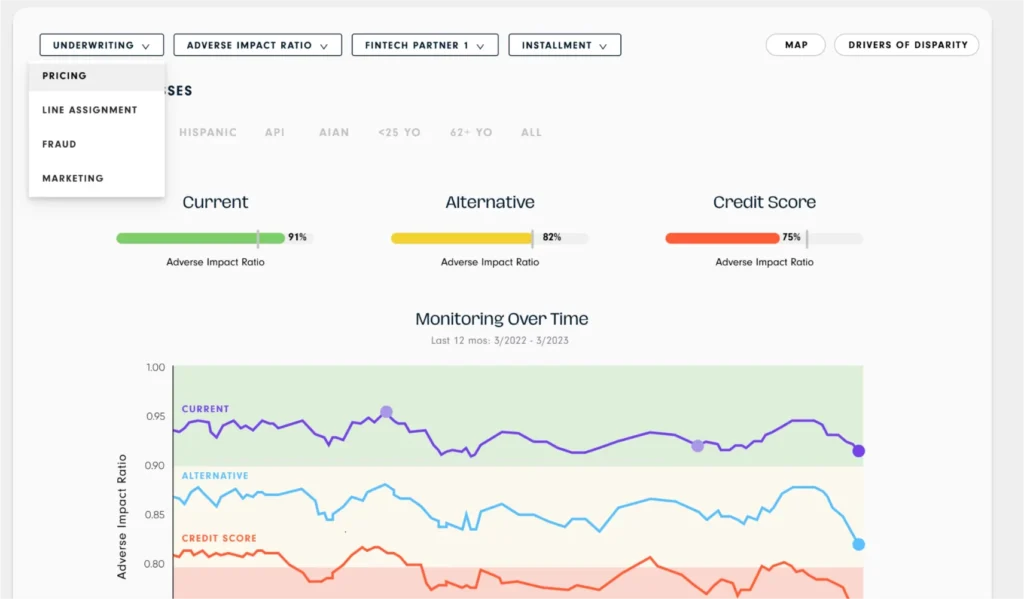

Monitor the fairness of your acquisition channels and fraud screens, as well as underwriting, pricing, and loss mitigation decisions

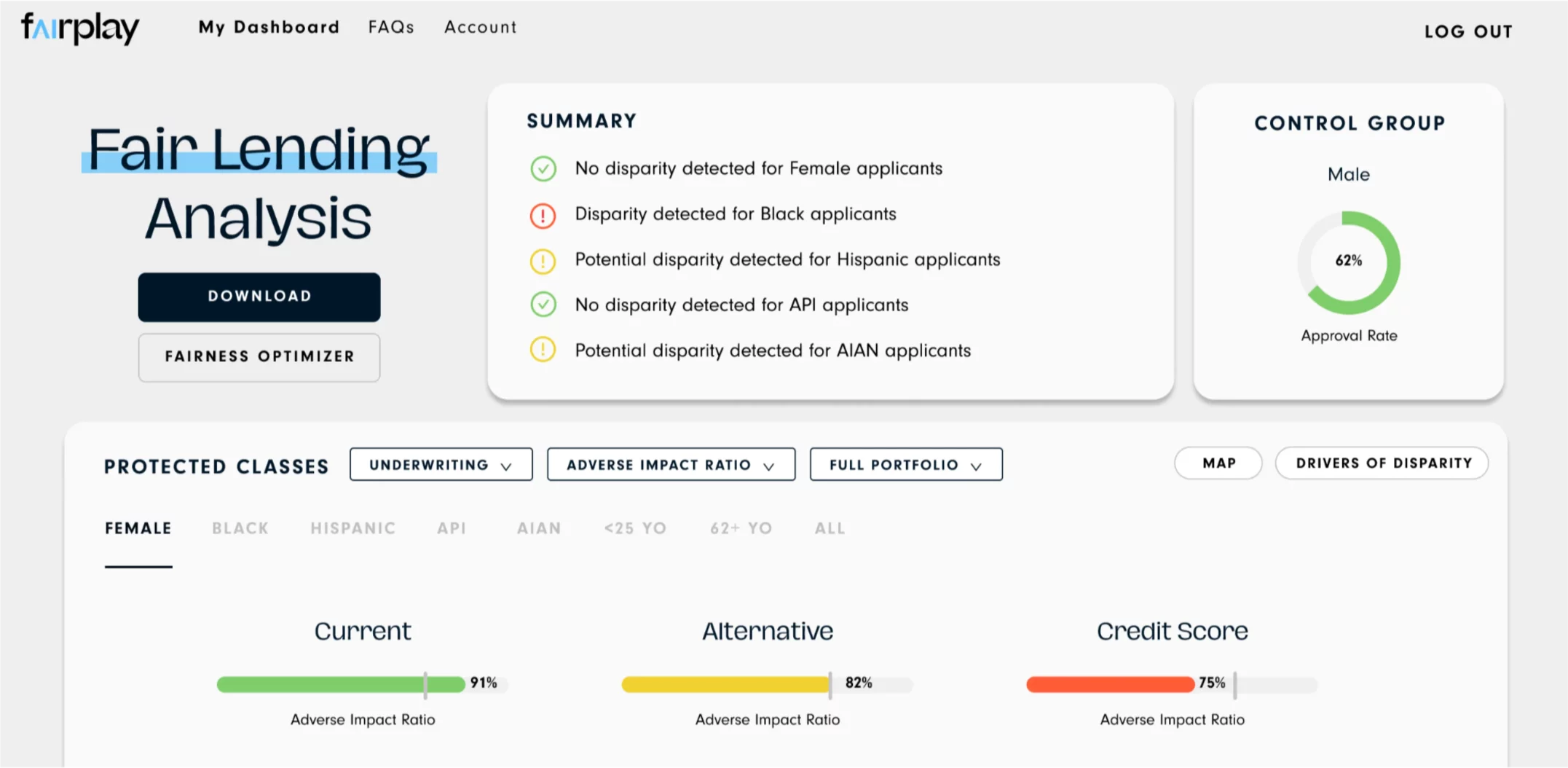

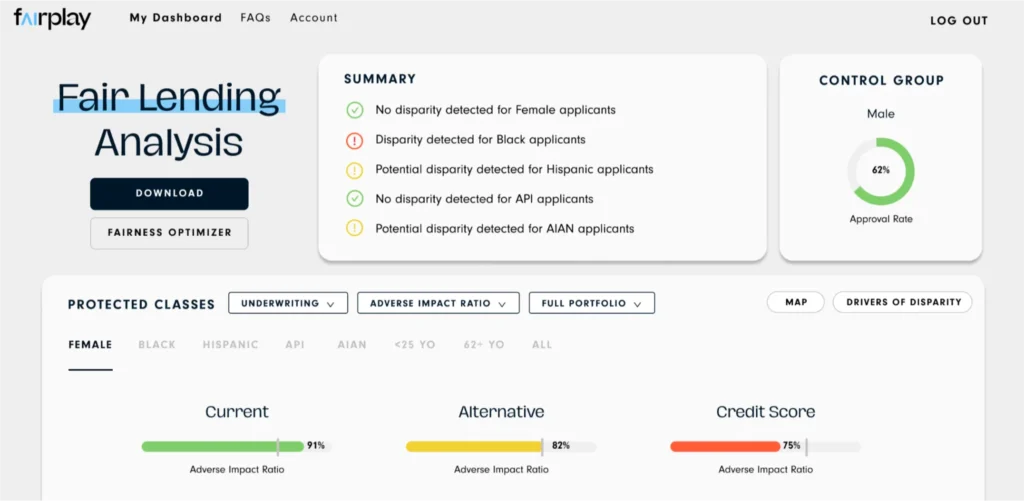

Automated Fair Lending

Instant fairness insights across all your lending partners

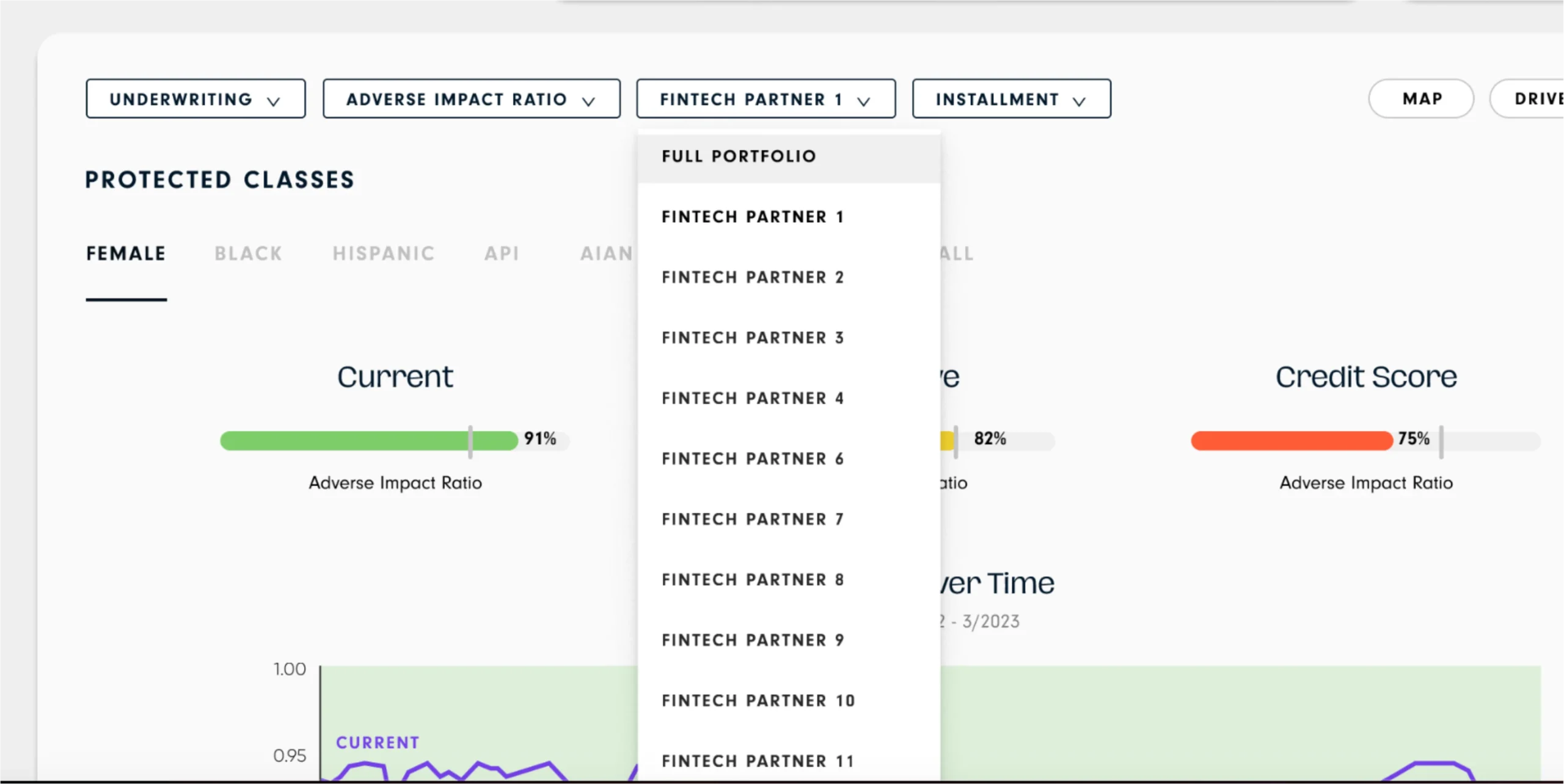

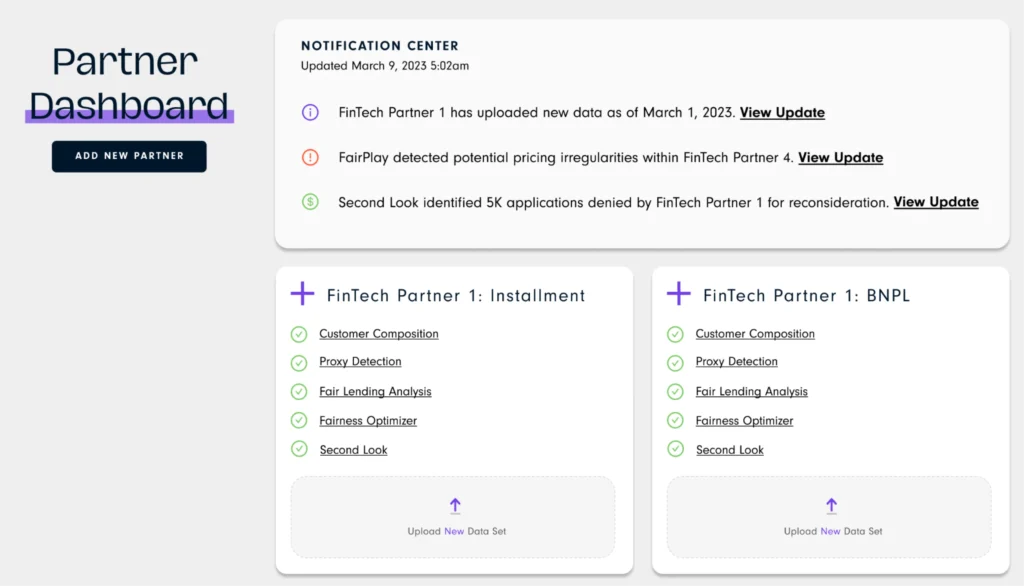

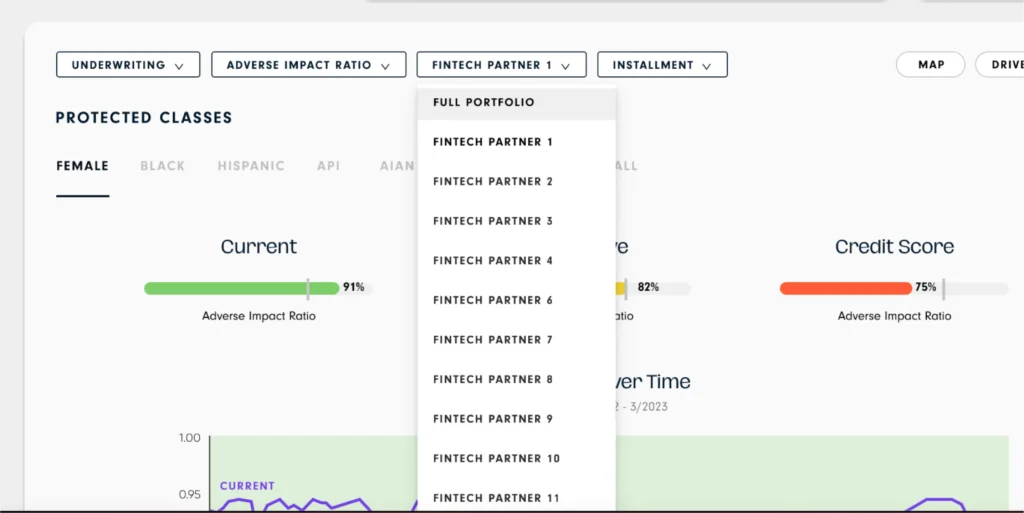

A unified view into the fairness of all your lending partners

See the fair lending performance of every lending partner and product.

Enable your partners with automated fair lending tools

Provide your partners with tools that make compliance obligations easy

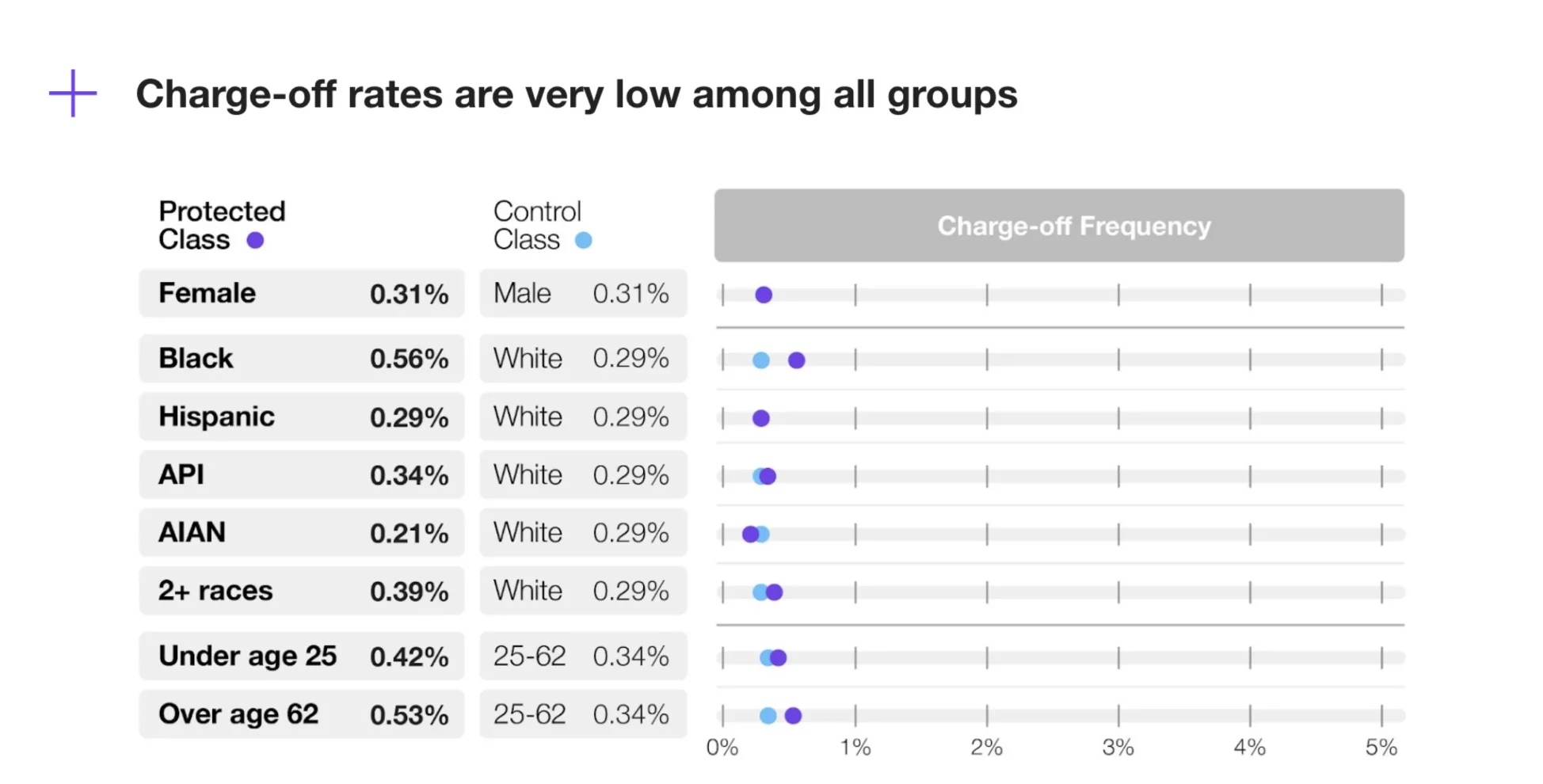

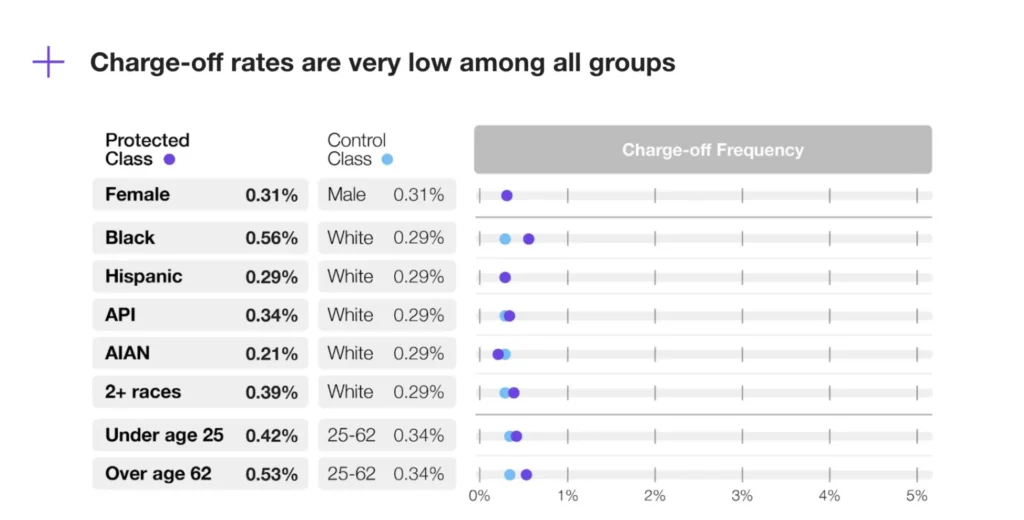

Detect disparate impact and whether it is driven by risk

Upload model inputs, outputs, and outcomes of credit, pricing and fraud models.

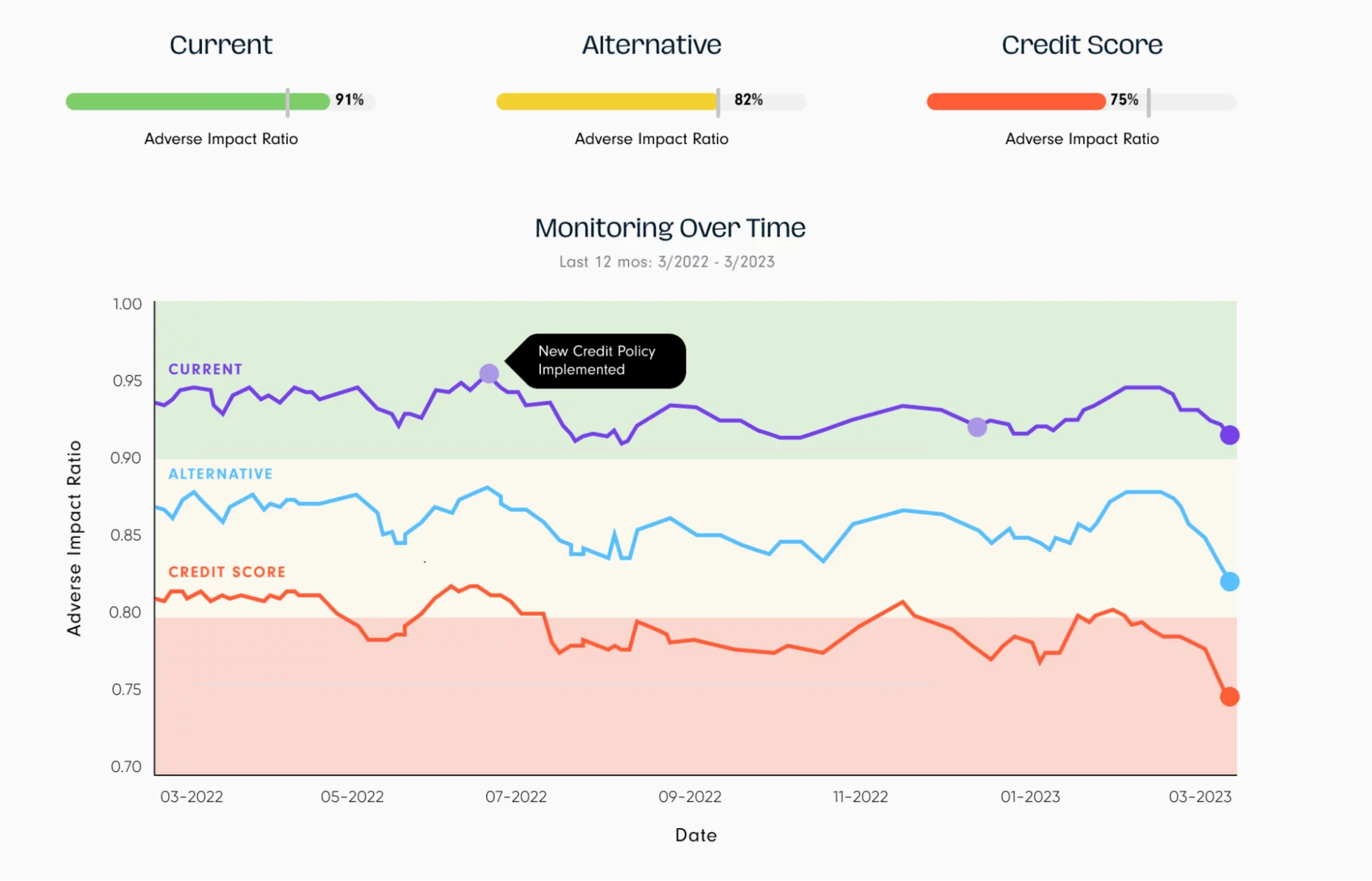

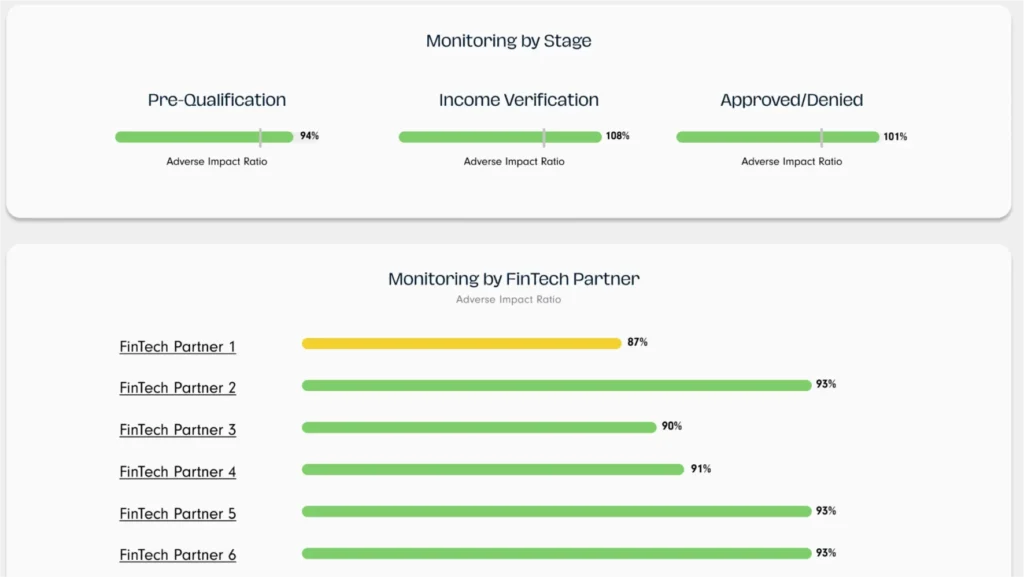

Fairness Monitoring

Real-time fair lending analytics across every partner

Monitor impacts on protected classes in real-time

Comprehensive fairness analytics across all your partnerships.

Identify risks for remediation before problems become significant

Populations change. The world changes. Guard against fairness degradation and proactively get in front of issues.

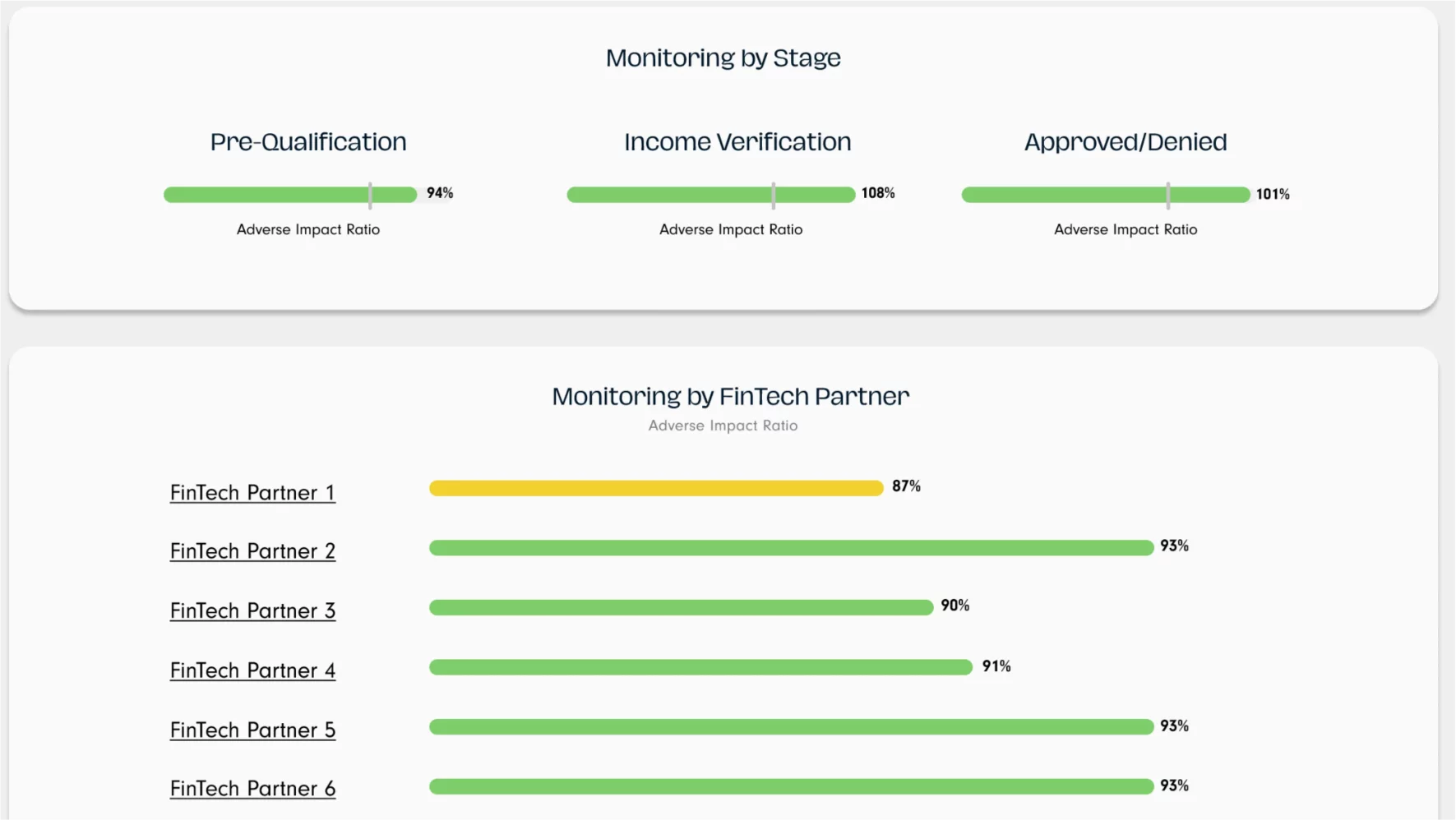

Monitor the fairness of every stage of a credit policy

Monitor the fairness of your acquisition channels and fraud screens, as well as underwriting, pricing, and loss mitigation decisions