A Fair Lending Platform built for

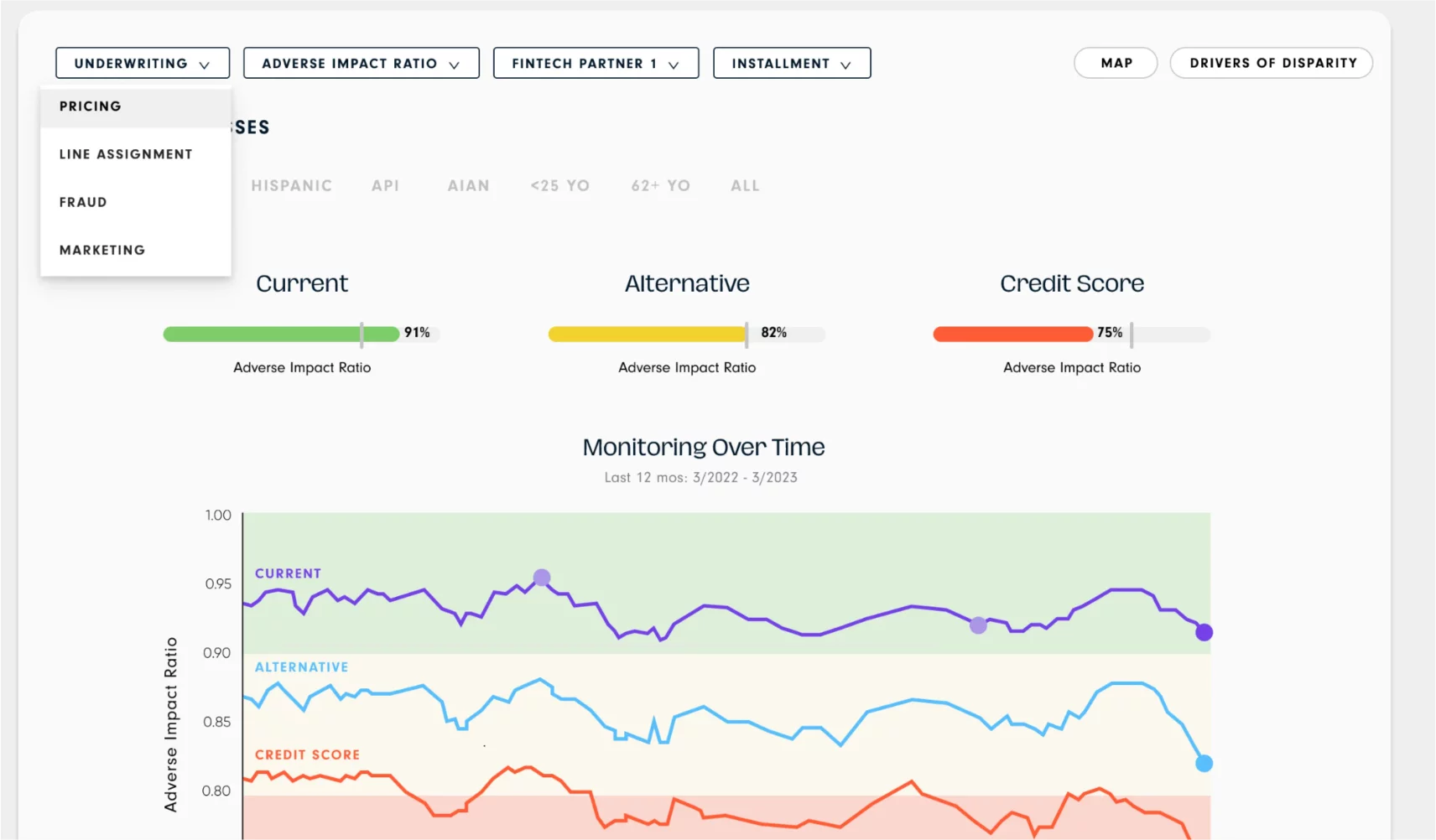

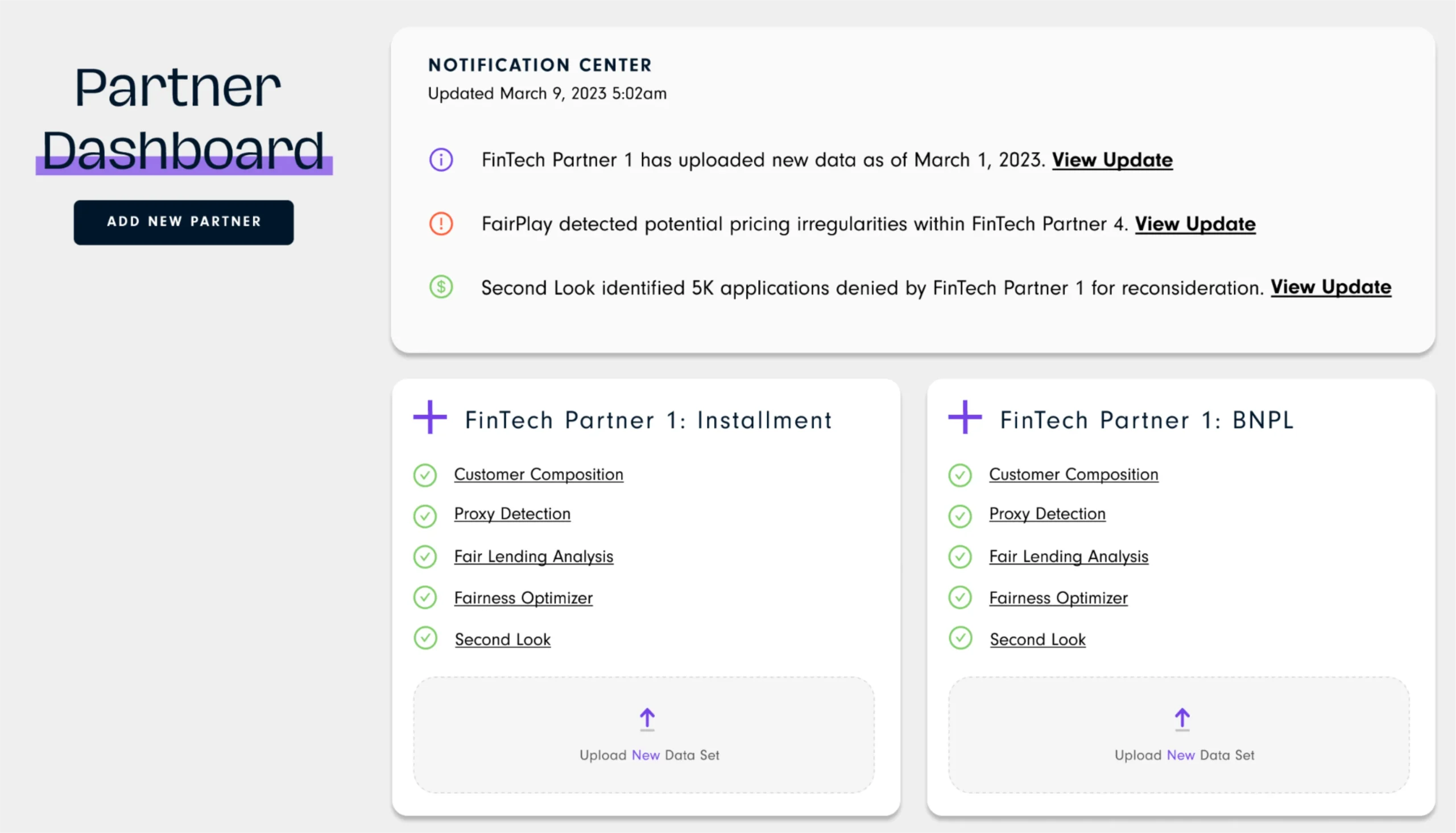

You can’t manage risk in the AI Age with Compliance from the Stone Age. Automate and streamline fair lending compliance for all your lending products.

Fair Lending Demo

Get a Demo Now! Experience the power of FairPlay today! Our experts will take you on a tour of our Fair Lending platform. See the future of fair lending for yourself.

Trusted by the leading compliance, credit risk, and data science teams at:

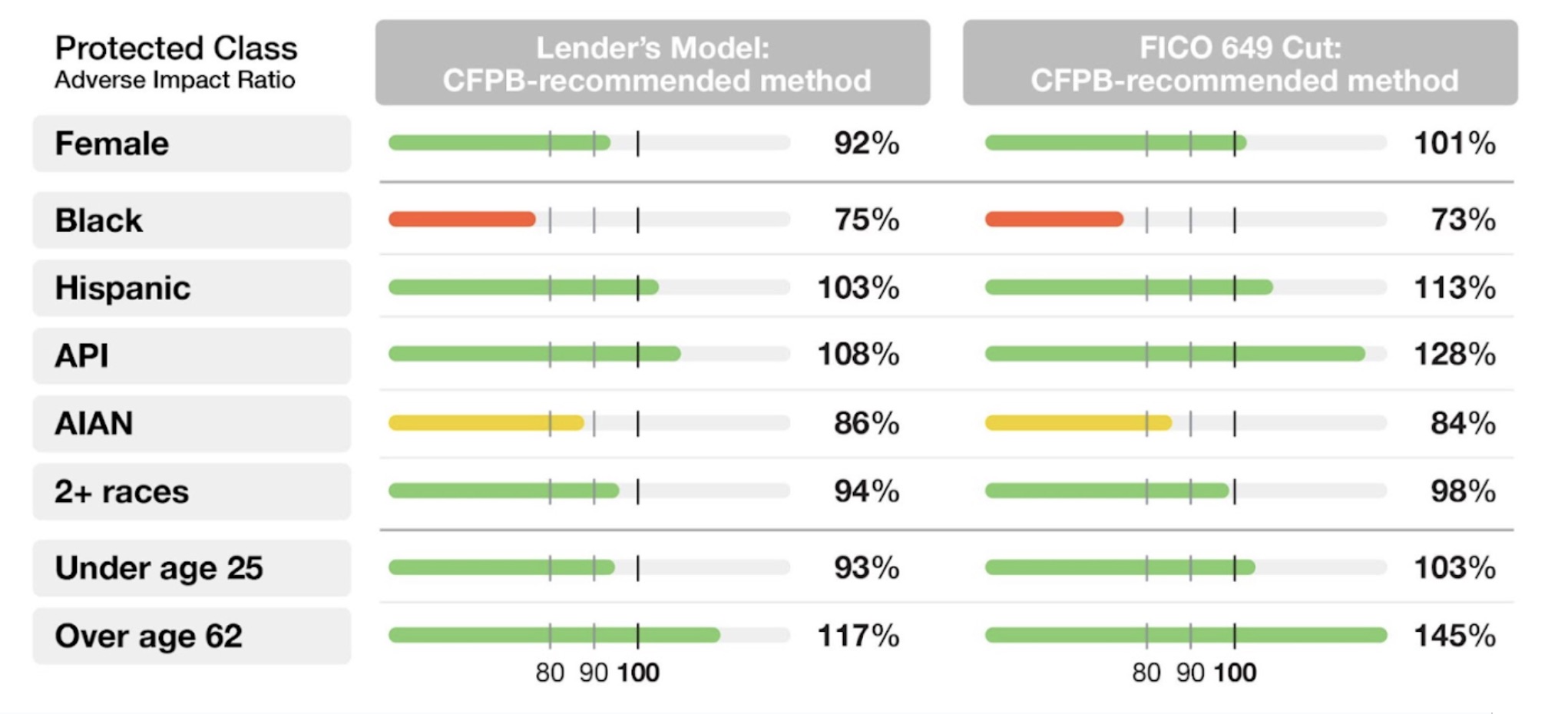

Automated Fair Lending